Empowering Your Financial Journey with Visa

Visa has become one of the world’s most trusted digital payment networks, powering transactions that connect people, businesses, and economies. In Brazil, Visa plays a central role in financial inclusion, security innovation, and frictionless payment experiences. This comprehensive guide explores how Visa supports consumers, entrepreneurs, and enterprises through advanced digital solutions designed for convenience, speed, and global interoperability.

Understanding Visa’s Global Payment Ecosystem

Visa is more than a card—it is a sophisticated infrastructure that moves money securely across borders, anytime and anywhere. Its technology enables fast authorization, fraud prevention, and seamless interactions between banks, merchants, fintechs, and consumers.

How Visa’s Network Works

- AI-powered fraud detection

- Tokenization for security in digital environments

- End-to-end encryption

- 24/7 global monitoring

This robust infrastructure empowers millions of Brazilians to shop, travel, start businesses, and access financial services safely.

Key Benefits of Using Visa in Brazil

1. Advanced Security Technology

Visa’s multi-layer security system protects every payment. Key protections include:

- Zero Liability for unauthorized charges

- EMV chip technology

- Real-time fraud monitoring

- Tokenization in digital wallets and online payments

These features work together to ensure each transaction is authenticated and encrypted.

2. Universal Acceptance

Visa is accepted in over 200 countries and territories, giving users unparalleled freedom. Whether shopping at a local business or making international purchases, Visa guarantees global interoperability.

3. Contactless and Digital Payment Innovation

Visa’s focus on user-friendly payment experiences includes:

- NFC Contactless Payments

- Visa Checkout & Click to Pay

- Integration with Apple Pay, Google Pay, Samsung Wallet

- Wearables compatibility (smartwatches, wristbands, rings)

These technologies reduce friction for both consumers and merchants.

4. Financial Inclusion and Local Development

Visa drives financial inclusion in Brazil by:

- Supporting early-stage entrepreneurs

- Partnering with fintechs and digital banks

- Enabling micro and small businesses to accept digital payments

- Developing education programs on financial literacy

Visa’s presence supports local economic growth and fosters innovation.

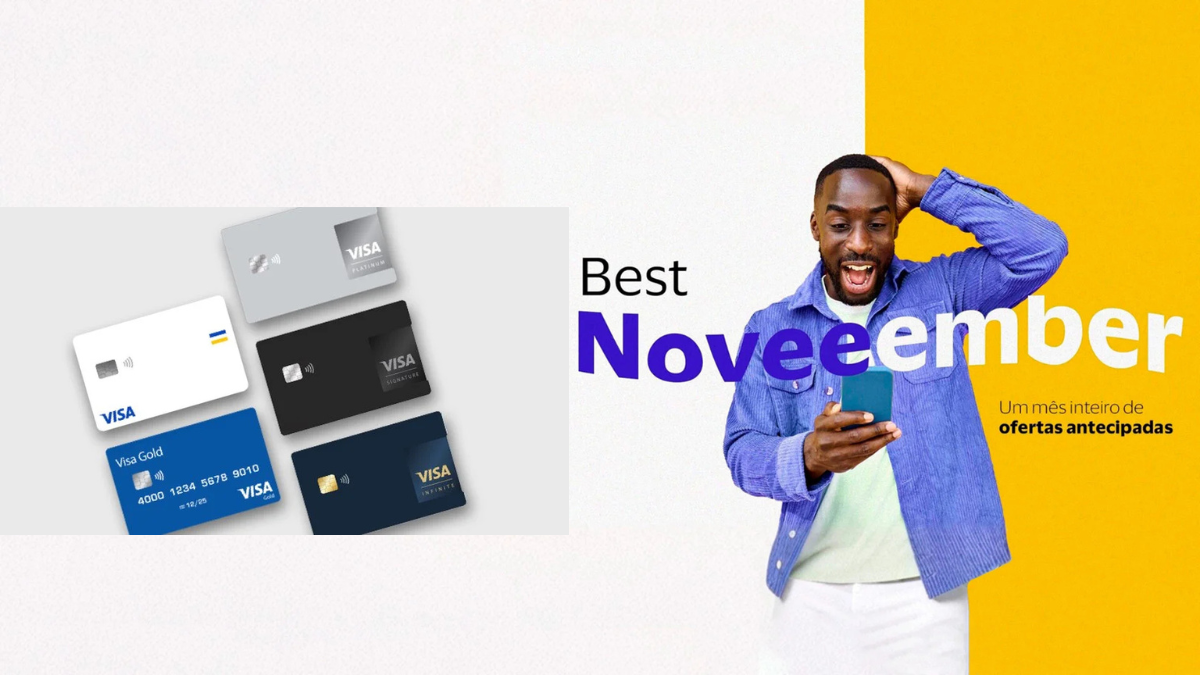

Visa Products and Solutions for Brazilian Users

Visa Classic

Ideal for everyday purchases, offering global acceptance and basic protection.

Visa Gold

Enhanced benefits, including travel assistance and extended warranty services.

Visa Platinum

Designed for frequent travelers, with perks like travel insurance and concierge support.

Visa Signature

Premium benefits such as luxury hotel privileges, airport lounge access, and advanced insurance coverage.

Visa Infinite

The highest-tier product with elite advantages, tailored for travelers and premium lifestyle experiences.

Visa for Businesses: Growth Through Digital Transformation

Visa empowers Brazilian companies with tools that accelerate digital evolution.

Business Solutions Include:

- Visa Direct (fast person-to-person or business-to-consumer payments)

- Virtual Cards

- Corporate Spending Platforms

- Fraud and Risk Management Tools

- POS and e-commerce integrations

Businesses can enhance cash flow efficiency, improve customer payment experiences, and expand globally.

Visa and Fintechs: The Future of Payments in Brazil

Brazil is a global center of fintech innovation, and Visa plays an active role by collaborating with startups and digital banks.

Visa supports fintechs with:

- APIs and developer tools

- Sandbox environments

- Partnership programs

- Processing infrastructure

This collaboration promotes more accessible and modern financial solutions.

Sustainability and Social Impact Initiatives

Visa invests in sustainable finance and social responsibility programs, including:

- Reducing carbon emissions

- Supporting local communities

- Empowering women entrepreneurs

- Expanding access to digital payment tools in underserved areas

Future of Payments in Brazil with Visa

Visa continues to lead in technological advancements that shape financial ecosystems. Trends include:

- Biometric payments (face recognition, fingerprint authorization)

- AI-driven money management tools

- Blockchain-powered transaction security

- Open finance integrations

These innovations ensure faster, safer, and more inclusive financial experiences.

Suggested Diagram (Mermaid)

flowchart TD

A[Consumer Payment] --> B[VisaNet Authorization]

B --> C{Fraud & Security Checks}

C -->|Approved| D[Issuer Bank]

C -->|Declined| E[Merchant Alert]

D --> F[Transaction Completed]

F --> G[Merchant Receives Funds]

Conclusion: Visa Powers a Smarter Financial Future

Visa stands as a global leader in secure, modern, and borderless payments. In Brazil, its role is even more impactful—supporting entrepreneurs, protecting consumers, enhancing digital experiences, and driving financial inclusion.

Whether you are shopping online, expanding your business, or traveling abroad, Visa ensures reliability, security, and innovation every step of the way.

Call to Action

Empower your financial journey today.

Choose a Visa card that fits your lifestyle and experience the freedom, security, and innovation of the world’s most trusted payment network.

👉 Explore Visa solutions through your bank or fintech and unlock smarter payments today.